Stop Being a Stranger, and Level Up to Where the Magic Happens!

You can transfer up to N1 million per transfer and N10 million per day. If that’s not freedom, what is?

You can transfer up to N1 million per transfer and N10 million per day. If that’s not freedom, what is?

When everything seems to be going wrong, and then someone offers you that age-old line: “When life gives you lemons, make lemonade.” And your first thought? Seriously? With what energy?

Ever felt like your degree came with vibes but no direction? You leave school and suddenly, everyone’s a tech bro, a content queen, or some “strategy consultant”…

Since the ATM card, payment has changed greatly! We’ve seen EMV chip cards, contactless payments, QR code transactions, and even biometric cards...but not worry, since you’re not ready to move forward, we will drag you into 2025 by force. Introducing CLOUD CARD!

It’s no surprise no one’s smiling these days, everyone’s in full survival mode, but here are 7 smart ways to ride out the storm.

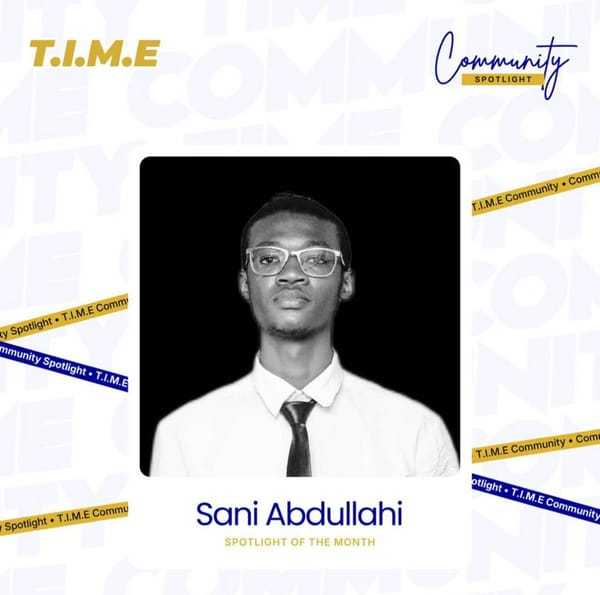

We're thrilled to unveil the very first star of our T.I.M.E (Tools for innovation mastery and equipment) Community, a segment dedicated to recognizing Young go-getters who are making waves and inspiring change! This month, the spotlight beams brightly on none other than Sani Abdullahi, a

There’s one relationship in this world that nothing can ever quite match, nothing compares to its unbreakable bond.

James couldn’t contain his excitement. His mom and two siblings were coming to visit him in the new city, and it had been so long since they’d all been together.

If your money keeps vanishing like a WhatsApp status, it’s time to address these 5 bad spending habits.

Women are the ultimate go-getters—running businesses, chasing dreams, breaking barriers, and still finding time to send “Have you eaten?” texts.

Women are the backbone of society, the queens of multitasking, and the only people who can have a full-blown emotional breakdown but still show up looking like a snack.

No more stressing over finding your wallet or trying to remember your card number.