Behind the Scenes: How Safe Haven MFB Links Multiple Cards to One Account

At Safe Haven MFB, we understand that managing finances as a couple or family should be seamless, not stressful. That’s why we’ve made it possible to link multiple debit cards to a single account.

Two Hearts, One Account: A Modern Banking Love Story

Imagine this: A couple, Sarah and Tunde, are out and about, each handling their own errands. Sarah's picking up groceries while Tunde’s grabbing lunch with friends. Both swipe their cards simultaneously, and the transactions go through without a hitch. What’s the magic here? Is it just luck, or is there something special about the way their bank account is set up? At Safe Haven MFB, this isn’t just a coincidence, it’s a feature, and today, we’re pulling back the curtain to show you how it all works.

The Power of One: Linking Multiple Cards to a Single Account

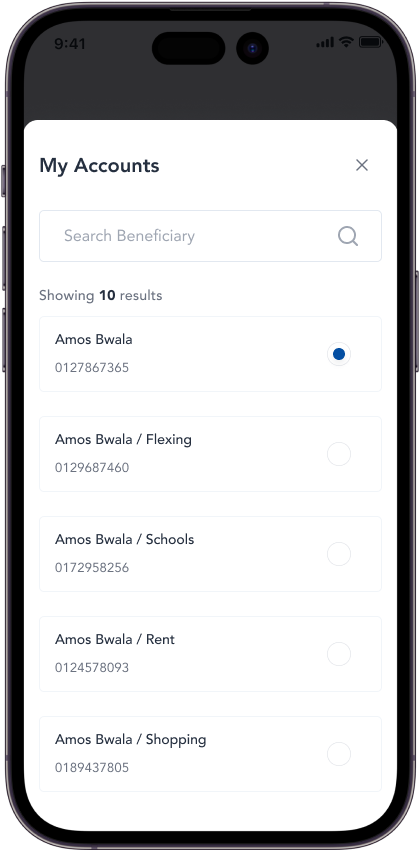

At Safe Haven MFB, we understand that managing finances as a couple or family should be seamless, not stressful. That’s why we’ve made it possible to link multiple debit cards to a single account. Whether it's a husband and wife, parents and children, or even business partners, this setup allows each cardholder to operate independently yet stay connected to the same account.

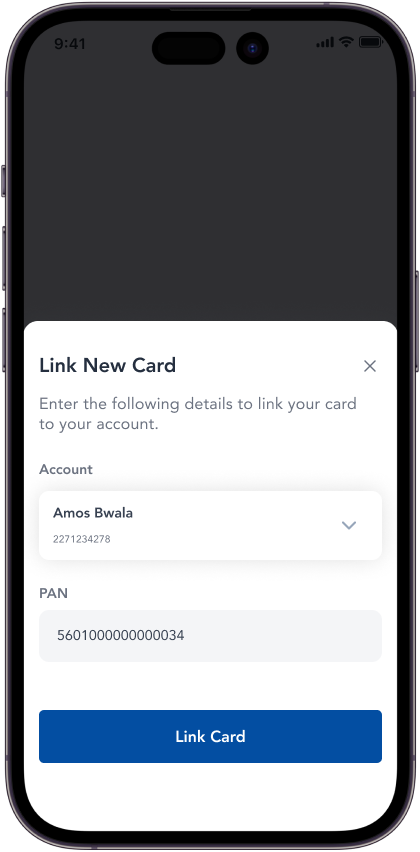

Here’s how it works:

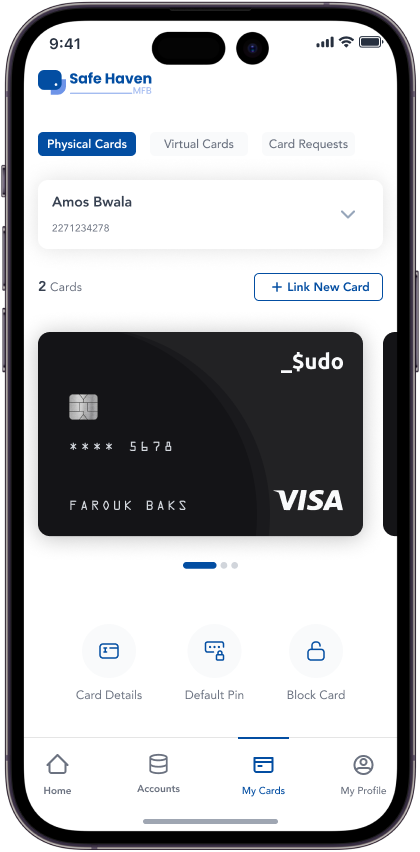

Unique Cards, Shared Account: Each card is unique to the individual cardholder but is linked to a single account. This means Sarah and Tunde can each have their own card, personalized with their names, yet both cards draw from the same pool of funds in their joint account. Even though they are linked to the same account, each card has its own PIN. So, in a situation where they accidentally swap cards, Tunde cannot use his PIN for Sarah's card, and vice versa.

Independent Yet Connected: Despite being connected to the same account, each card operates independently. So, when Sarah is at the grocery store and Tunde is at lunch, both can swipe their cards simultaneously. The transactions are processed as if they’re using two separate accounts, but in reality, they’re drawing from the same balance.

Remember, I mentioned the ability to have multiple accounts? Well, we offer that here at Safe Haven MFB too! In case you missed it, here you go. Whether you're looking to manage funds separately or together, we’ve got you covered.

How Does It Work? The Tech Behind the Scenes

It might seem like magic, but there’s some serious tech behind this feature. When you swipe your card, our system recognizes it as a transaction request from your unique card number. It checks the balance in your shared account and processes the transaction in real-time, ensuring there’s no overlap or conflict, even if two transactions happen at the same moment.

Here’s the breakdown:

- Card Identification: Each card has a unique identifier, even though they are linked to the same account. This ensures that transactions can be tracked and managed separately, even though the funds come from a shared source.

- Real-Time Processing: When a transaction is initiated, our system instantly verifies the available balance and processes the payment. This real-time processing ensures that each cardholder can use their card simultaneously without any hiccups.

- Transaction History: Each cardholder's transactions are recorded separately in the account’s transaction history. This way, Sarah can see what she spent at the grocery store, and Tunde can track his lunch expenses, all within the same account.

Why It Matters: Simplifying Shared Finances

Managing a shared account doesn’t have to be a balancing act. By linking multiple cards to one account, Safe Haven MFB makes it easy for couples, families, and partners to manage their finances together without the hassle of coordinating every purchase.

Use Cases: More Than Just for Couples

This feature isn’t just for married couples; there are countless scenarios where linking multiple cards to one account can simplify life:

- Parents and Teens: Parents can give their teenagers a debit card linked to the family account, allowing them to make purchases while still keeping an eye on spending.

- Business Partners: Two business partners can each have a card linked to the company account, making it easier to manage expenses without constantly checking in with each other.

- Frequent Travelers: If one partner is traveling while the other is at home, both can access funds from the same account without needing to transfer money back and forth.

Conclusion: One Account, Many Possibilities

At Safe Haven MFB, we believe that banking should adapt to your life, not the other way around. That’s why we’ve made it possible to link multiple cards to a single account, giving you the flexibility to manage your finances the way you want. Whether you’re shopping separately or paying for a meal together, our system ensures that your transactions are smooth, secure, and synchronized.

So the next time you and your partner are out and about, remember, your Safe Haven MFB account has you both covered, no matter where life takes you.

Ready to embark on this financial adventure? Let Safe Haven MFB be your guide. Download the app on the App store and Play store TODAY!!!