Surviving the Naija Hustle: A Financial Journey from Dreams to Reality

Surviving the Naija Hustle: A Financial Journey from Dreams to Reality

Growing up, I had big dreams fueled by hope and imagination. I pictured myself making enough money. But life, or should I say 'village people,' had other plans. By 30, I'd planned to own a house, a car, be married, and have three kids. Perfect, right? Yet, here I am at 28, still struggling with life, and trying to make it happen.

Fresh out of secondary school I landed an 80k job and felt like my dreams were kicking off. I was buzzing, ready to make things happen. But soon, reality hit harder than Lagos traffic. Bills piled up, and I was barely managing transport, food, spendthrift and helping my siblings. There was a huge gulf between my dreams and reality, and I had to learn fast about financial survival and the only way of saving is letting go of one.

So, here I am, a graduate deep in my mid-career hustle. I was expecting a fat pay raise but ended up with 65k—chai! Between rent, groceries, and sibling support, my salary vanished faster than NEPA light. The economy's rollercoaster, especially with this dollar wahala, made saving feel like a pipe dream and letting go of one of my spending habits became paramount. It's clear now—I either need a solid plan to chase those childhood dreams, or maybe just quietly enjoy my money while someone else plays the family hero.

After: Future Goals

From Hustle to Savings, My Naija Money Began

But as a fresh Nigerian graduate navigating this chaotic Sapa economy, let me tell you, it's no joke! I mean, earning 80k in a month used to be like hitting the jackpot back in 2009. But now, with all the transportation costs, bills, and supporting my younger brother, there's barely anything left to save.

But hold up! Don't worry, I'm a resourceful Nigerian and I always manage to save something, no matter how small. However, just saving wasn't cutting it for me. I wanted my money to work for me. So, I tried different investment plans, but nothing really clicked… until one of my besties (EVE) told me how she was using SUDO's Dollar investment plan to run streets!

You all! This Dollar investment plan is a game-changer! It lets even small amounts of money work wonders for you. Whether you're a big saver or just scraping by, this plan has your back and as a girl wey sabi, I'm not going to keep this to myself! Nope.

Life in Naija is tough, but by staying sharp with my money, I stay ahead, no matter what.

I know the hustle of making ends meet. When my salary took a hit, I didn’t panic. Why? Because I was sharp enough to save in dollars when the rate was between 600-900. Thanks to Root by Sudo, I could save dollars and stay afloat. Plus, being a personal shopper on Shein gave me extra cash. I earned in dollars and saved for those rainy days.

That side hustle meant a lower salary wasn’t the end of the world for people like us wey just dey start life. It taught me the value of investing in my future. Remember, a lower paycheck is just a challenge to be smarter with your money.

How does a stronger dollar influence individuals and companies?

Operational Costs: When the naira starts doing the moonwalk, businesses like Sudo feel the heat. Import costs go up, profits take a nosedive, and suddenly, they’re stuck between tightening their belts or slapping on higher prices. It’s like trying jollof rice with no pepper—something’s gotta give!

Capital Flow: Imagine the dollar doing shaku shaku, and international investors are like, “Abeg, let’s move our money to safer dollar investments!” This switch-up can scatter the investment vibes in Naija, making it harder to chop stocks and bonds. It’s like turning your local market into a game of ‘find the pepper’—not easy!

Consumer Purchasing Power: For us regular folks, a weak naira means things just got more expensive than suya at a fancy Lagos restaurant. Our spending power shrinks, and we’re left calculating whether to buy that big-ticket item or stick to the basics like garri and groundnut.

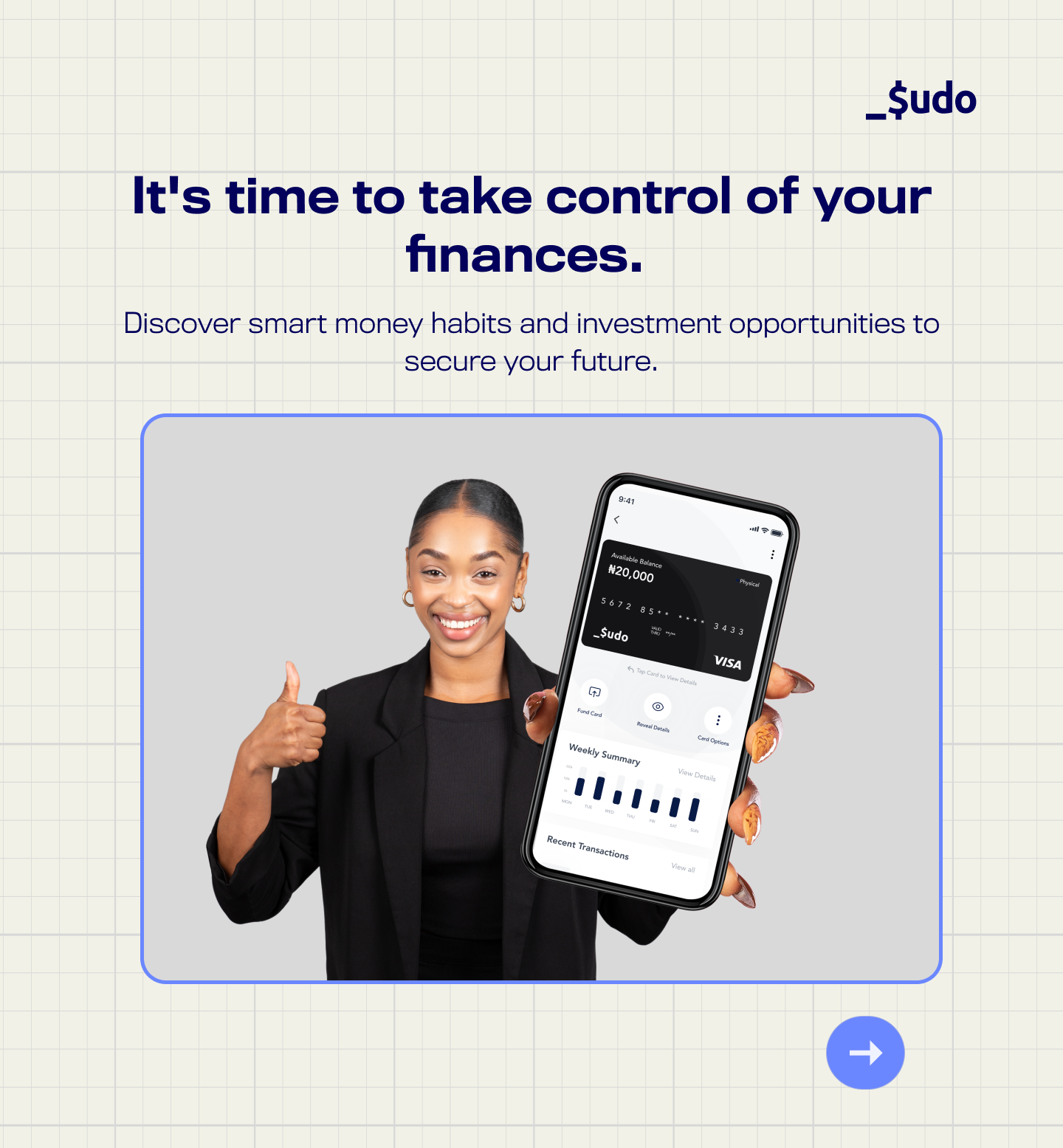

Financial Management with Sudo’s Dollar Card:

Meet your new financial bestie—The Root by Sudo dollar card. It’s the ogbonge solution you need to stay sharp and savvy in these wahala times. Here’s why:

- Direct Dollar Transactions: Make purchases in USD without the hassle of conversion, benefit from parallel market rates with no hidden fees, and start funding your card from just one dollar.

- Exchange Rate Shielding: Keeping your money in dollars shields it from currency fluctuations, preserving its value longer.

- Convenience and Security: Perfect for everyday use and travel, offering secure payment features that keep your cash safe and accessible.

- Savings Strategy: The Root by SUDO dollar card helps you manage your finances better, ensuring you save and spend wisely.

Navigating salary changes from the past to the future requires solid financial planning. With tools like the Root by Sudo dollar card, you can handle the dollar’s impact on your finances and adopt winning money management strategies. My journey has taught me that a lower salary isn't the end—being smart about saving and making extra cash is key.

With Root by Sudo dollar today! You can hop on their Dollar investment plans, and watch your money grow while you relax and live your best life.

Want convenience?...Download Root by Sudo on the App store or Play store today!